People have been very excited about the recently launched social security schemes – Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY),Pradhan Mantri Suraksha Bima Yojana (PMSBY)and Atal Pension Yojana (APY). They are flocking to their banks to get more details about all these schemes and get themselves subscribed to these schemes as early as possible.

With a life cover of Rs. 2 lakhs, I think PMJJBY is a great scheme which promises to cover India’s entire population for a low annual premium of just Rs. 330. This scheme is highly suitable to our working population on whom their family members are dependent for their survival and growth. On the other hand, at an annual premium of Rs. 12 for an accidental disability and death cover of upto Rs. 2 lakhs, there is no doubt in my mind that PMSBY is a really cheap mode of getting yourself covered against fatal accidents.

But, if I analyze whether PMJJBY is the cheapest term plan available in the market with an annual premium of Rs. 330 for a life cover of Rs. 2 lakhs, I find that it is not the case if you are a relatively young person, can afford to pay higher premiums and probably don’t mind getting yourself covered with private insurers as well. In other words, there are some better options available in the market as compared to PMJJBY with proportionately lower premiums and higher sum assured.

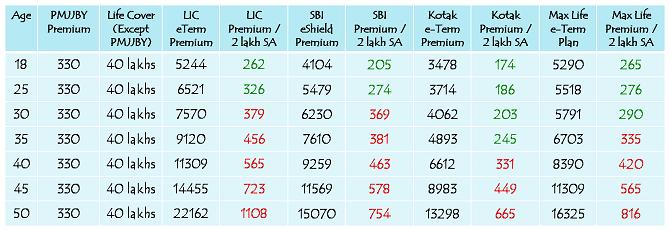

PMJJBY vs. LIC eTerm, SBI eShield, Kotak Preferred e-Term & Max Online Term Plan

Note: All figures in the table above are in Rupees, except Age.

LIC is the most trusted life insurance company in India with the highest claim settlement ratio. It is a known fact and I need not convince anybody about this fact. If you check the table above, LIC’s online term plan – LIC eTerm Plan, is costing Rs. 5,244 and Rs. 6,521 for a cover of Rs. 40 lakhs to a couple of individuals, aged 18 years and 25 years respectively. If I divide Rs. 40 lakhs by 20, I get a cover of Rs. 2 lakhs and if divide Rs. 5,244 and Rs. 6,521 by 20, then I get Rs. 262 and Rs. 326 respectively.

Rs. 262 and Rs. 326 are the premiums I need to pay to LIC per Rs. 2 lakhs of life cover at the age of 18 years and 25 years respectively. I need not emphasize that Rs. 262 and Rs. 326 are lower than Rs. 330 which I would be required to pay as the premium for a life cover of Rs. 2 lakhs when I subscribe to Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY).

As I become older, say more than 25 years of age, LIC starts charging me more for the same life cover of Rs. 40 lakhs. If I am 30 years old, LIC charges me Rs. 379 for a cover of Rs. 2 lakhs and if I am 50 years old, the premium goes up very sharply to Rs. 1,108 for the same life cover. Please note that these are only proportionate premiums and LIC would charge me more if it is to provide only Rs. 2 lakh of life cover.

Similar is the case with SBI Life’s online term plan, SBI eShield. SBI Life charges even less than what LIC charges for its online term plan. For a cover of Rs. 40 lakhs, you need to pay just Rs. 4,104 and Rs. 5,479 if you are 18 and 25 years old respectively. That is Rs. 205 and Rs. 274 respectively for a proportionate life cover of Rs. 2 lakhs.

As you can check from the table above, Kotak Life Insurance provides the cheapest online term insurance among the four companies I decided to select for this comparison. Even Max Life Insurance provides cheaper life cover as compared to LIC, but it is costlier than Kotak Life for all age groups and costlier than SBI Life in some extreme age groups and cheaper in some middle age groups.

So, why PMJJBY is costlier than other Online Term Plans? The answer lies in the fact that every insurance policy has some operational expenses and incentives for the intermediaries which provide services to their customers. All these expenses would be relatively higher for an insurance policy with a lower sum assured and lower premium and relatively lower for an insurance policy with a higher sum assured and higher premium. I think this is the reason why PMJJBY is costlier than other online term plans in some of the age groups.

So, younger age group subscribers would be subsidising older age groups in PMJJBY?Probably yes and rightly so. As you know, in PMJJBY, the premium would remain the same at Rs. 330 for a life cover of Rs. 2 lakhs for all the subscribers aged between 18 and 50 years, and going upto 55 years. We all know that the probability of dying at the age of 50 years or 55 years is way higher than the probability of dying at the age of 18 years or 25 years.

So, ideally the premium for your life cover should be lower at a younger age and higher at an older age, which is there in all other online term plans. But, that is not the case with PMJJBY. In order to keep it fairly simple and beneficial to all the Citizens of India, the government has decided to keep the premium uniform at Rs. 330. Though I do not favour any kind of subsidy and I think either younger subscribers or the government would be subsiding older subscribers in PMJJBY, I think it is a great move to keep it fairly simple and encourage a large population to get associated with PMJJBY.

Service Tax Exemption Advantage – Lastly, I would like to highlight it here that PMJJBY has been exempt from service tax of 14% and that already places this scheme at a slightly advantageous position as against other insurance plans. All other schemes attract service tax and it is included in all the premiums mentioned above in the table.

So, the conclusion of this exercise is that PMJJBY is a great scheme launched by the Modi Government, but if you are a relatively younger subscriber and feel Rs. 2 lakhs of life cover is on a slightly lower side than your actual requirement, then you should opt for an online term plan of a higher value either with LIC or SBI or Kotak Life or even Max Life. Older and eligible subscribers should simply subscribe to PMJJBY as Rs. 330 is the cheapest premium of all for their age groups.

Moreover, I think Pradhan Mantri Suraksha Bima Yojana (PMSBY) is the cheapest accidental death and disability insurance policy and you should definitely subscribe to it. PMSBY covers you till the age of 70 years, as against 50-55 years till which PMJJBY provides you the life cover.

This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in